How to Value a Business

A crucial step before selling your business is to determine an accurate business valuation, therefore wondering how to value your business and using a business valuation calculator should be a top priority if you are thinking of selling. The entire selling process hinges on finding an accurate price – if the price is too high, you’ll struggle to attract buyers, but if the price is too low, you’ll miss out on your hard-earned money.

Wondering how you value a business quickly?

We’ve got great news... At Intelligent, we have over ten years of experience in providing accurate valuations for businesses, and we’ve found several ways to generate an asking price that is fair for both buyers and sellers alike, so we’re going to share all of the different ways to value your business in this guide.

After that, we’ll let you in on some of the ways you can increase your value as well as some pitfalls you may want to be aware of.

When assessing the value of a business and how to value a business for sale, we can start here: The multiple of profits. This is often the basis for other valuation techniques.

Multiple of profits calculates the profits a buyer will be able to extract from a business before interest, taxes, depreciation, and amortisation. The multiple ratios used vary according to industry, location, size of the business and turnover.

Although the general calculations might be relatively easy to arrive at, there is no standard ratio that can be used across all types of business.

This method also factors in asset value and freehold value (if you own the property you operate from) to help bolster your business’s value.

How to determine the value of your business includes assessing the entry valuation. An entry valuation is rather unique as it looks at how much it would cost to set up a similar business rather than purchasing yours.

It also looks at how much it would cost to purchase all the assets in your business, the cost of training staff, building a customer base and even how much it would cost to develop the product you sell.

This type of valuation can be useful for more corporate companies, rather than say cafés or coffee shops, and companies deciding whether to enter a market or purchase an existing business will look to this method in particular.

For companies with plenty of assets looking to value their business (manufacturing businesses and property businesses as an example), an asset valuation should be used.

Here’s why:

This method simply looks at the total assets minus the total liabilities of your business. The key to an accurate asset valuation is getting your books in order and making sure that all the figures are correct.

Ensure that your books are up to date and that all values (and liabilities) listed are accurate and representative as this will be what determines the business’s value and any clued-up buyer will notice if the numbers are incorrect.

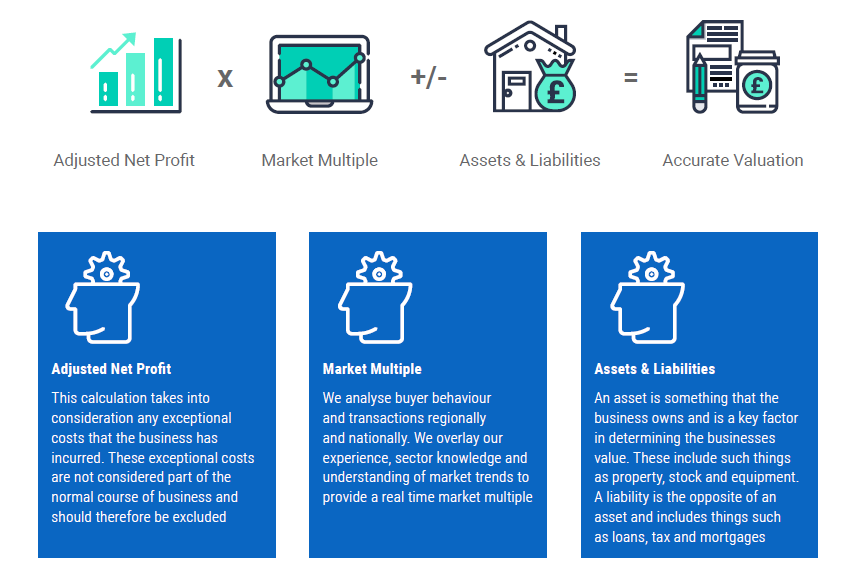

Here at Intelligent, we understand the importance of obtaining an accurate professional valuation to ensure an efficient sale of your business. There is no one-size-fits-all approach when it comes to valuing a business...

However, we do have a baseline formula that is used by our experts when valuing a business. Our team analyses your company’s finances and external factors to make sure we use the correct figures in each component of the formula, therefore resulting in an accurate valuation.

To value a small business based on revenue, you need to gather your turnover to date for your current financial period and add it to the turnover for your previous financial period, if available, remembering to exclude VAT from your total turnover.

You must then divide the total turnover by the number of weeks in the time period, this gives you an average weekly sale figure which compensates for seasonal fluctuations.

Next, you must determine how many weeks of turnover equate to a fair value of the business, this is difficult to decide as the number of weeks varies between different sectors.

One thing to keep in mind, however, is that the main disadvantage of valuing a company based on turnover versus a professional valuation is that it fails to consider how factors outside of financial matters, such as the surrounding environment, affect the business’s value.

Valuing your business based on its turnover, therefore, runs the risk of being unrealistic, which is why we recommend you sign up for a free, instant professional business valuation.

Nonetheless... valuing your business on its turnover is a good place to start and it’s particularly helpful for newer businesses whose broader financial picture has been impacted by high start-up costs.

To calculate a business’s value based on the profit you need two figures:

The company’s annual adjusted net profit and a price-earnings ratio (P/E ratio).

You then multiple the annual profit by the selected P/E ratio to gain your business value. The correct P/E ratio varies according to sector, business size, previous profit track record, and whether pre-tax or post-tax profit is used in the calculation.

This method is ideal for businesses with a fairly extensive record of annual profits.

It also enables buyers to easily calculate the annual percentage return they will gain after each year of owning the business. On top of this, it provides a clear timeline of when they will get the full return on the investment.

Congratulations! Now you know the different methods of determining a business valuation and are ready to value your business successfully.

But how can you maximise the value of your business to make the most out of your sale?

Read on to find out our top tips for raising the value of your business and what may negatively affect your value...

Naturally, after finding out how much your business is worth, you may ask “how do I increase the value of my business?”.

Luckily, there are many ways a small business owner can raise the value of their business, ranging from quick fixes to lengthy tasks...

Often the most overlooked, yet incredibly important, aspect of getting a business valued is ensuring that your books are in order.

It’s all too easy to let them get out of hand and any serious buyer won’t consider a business that doesn’t have up-to-date records available so preparing in advance will save you time later and help your valuation now.

As with buying a house, a business that has many small, niggling issues won’t be as attractive to a buyer as one with everything fixed.

This makes sense since buyers rightfully want a guarantee that everything is in working order. Perhaps there are a few things that need fixing in the business; be it a till that’s not working or fridges that are out of date.

Fixing before a valuation will help you to make more of your business’s worth.

All businesses naturally have good and bad periods. It can be seasonal, it can be weather-related, and it could even be there is a lack of demand at certain times, however, the key here is to look for a valuation during a good time.

You might want to sell because your business is having a rough time, but want to make the most whilst it’s good. However, Buyers want to buy businesses that are performing well, which might mean you’re going to have to sell while you’re in the middle of a great season. Assess your value at a good time and you’ll benefit greatly.

As values can go up, they can also go down so to ensure your business achieves the highest possible value, look to avoid the following...

Values are very much dependent on what a buyer will pay for a business.

On top of this, buyers always pay more for businesses with clear growth prospects. This can be a catch-22 as you’re unlikely to sell your business when there’s a clear path to growth, however, if you can’t demonstrate anywhere to grow the business, your value will suffer.

Business owners enter into contracts with suppliers for many reasons.

Perhaps you’re not allowed to market or compete in certain areas, or you’re paying above the odds for stock and these will affect your business’s value.

All businesses come with risk, this is something that cannot be completely avoided.

However, If your business has more risk than the next business for sale, your value in the eyes of the buyers will decrease.

An owner-operated business presents a greater risk to a buyer than one with an existing management team in place, whilst relying on one supplier could leave your business scuppered if the supplier shuts down.

At Intelligent, we know how to value your business through a valuation calculator.

That’s why we provide a FREE business valuation for any small business owner looking to find out the value of their business.

Value your business instantly by using our online valuation tool below!

Get quick and easy insight into the real value of your business, without any obligations.

At Intelligent, all our experts use a specific formula that will give you a free and highly accurate baseline valuation so that you've got a figure to work with that most realistically resembles the value of your business.