How to Sell a Commercial Property

Do you have a commercial property that you’d like to sell?

The commercial property industry employs over a million people in the UK – that equates to 1 in every 32 jobs.

From office space, to student housing, catering premises and retail units – being a commercial landlord can be an extremely lucrative enterprise.

Therefore, it’s no wonder buyers are keen to snap up commercial properties whenever they come on the market.

Whilst there are a few similarities, selling a commercial property has some key differences to selling a residential home.

That’s why we’ve put together a comprehensive guide to talk you through how to sell a commercial property, from valuation to completion.

The value of a commercial property will depend on many factors, such as its potential rental income, the sale price of similar properties nearby and its size.

We’d recommend contacting a RICS surveyor or an individual with similar qualifications to conduct a formal valuation of the property itself.

If you are selling your commercial property and a business at the same time, you will need to combine the value of the property and the value of the business before selling. To do this, you will need to conduct as separate valuation to discern how much the business is worth.

To do this, you will need to consider the business’ assets and goodwill.

The assets held by a business will obviously vary from business to business, but could include:

High quality assets will make your business more attractive to potential buyers, they’ll be reassured by the fact that they won’t have to replace anything anytime soon.

Calculating the goodwill value of a business can be a little trickier. Here are some elements that can contribute to this:

For many business owners, it can be had to be impartial when valuing their own business. That’s why we’d recommend employing the help of a professional business broker at this stage of your valuation.

At Intelligent, we have a dedicated expert team with years of experience in calculating the value of hundreds of coaching, education & training businesses.

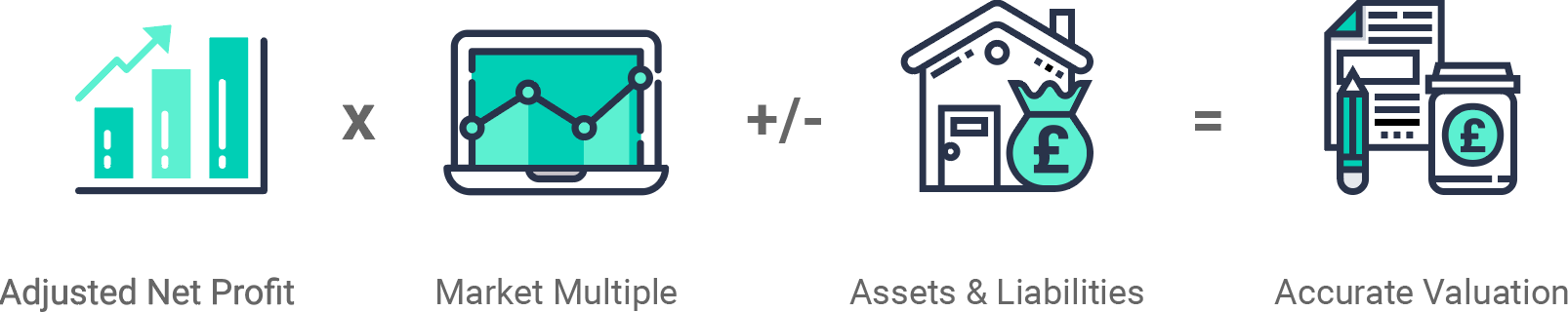

We use a tailored approach, taking the time to understand you, your business and your goals, but we use the same basic formula as shown below:

Adjusted Net Profit

This calculation takes into consideration any exceptional costs that the business has incurred. These exceptional costs are not considered part of the normal course of business and should therefore be excluded

Market Multiple

We analyse buyer behaviour and transactions regionally and nationally. We overlay our experience, sector knowledge and understanding of market trends to provide a real time market multiple

Assets & Liabilities

An asset is something that the business owns and is a key factor in determining the businesses value. These include such things as property, stock and equipment. A liability is the opposite of an asset and includes things such as loans, tax and mortgages

There are a number of steps you should follow before putting your commercial property on the market. Before you start searching for a buyer, you should begin to pull together the relevant documents and information that your potential buyer will need to see.

There are also some things you can do to make the property as attractive an opportunity as possible. This can help drive more buyer enquiries and help you achieve the best possible price.

Here are some key elements you should start thinking about whilst preparing to sell your commercial property.

An easy way to make your commercial property more attractive to potential buyers is to conduct some general maintenance and repairs.

Attending to any general wear and tear will make allow a buyer to see the full potential of the property, rather than focusing on areas that need improvement.

It is worth noting, however, that whilst repairs and maintenance are essential you shouldn’t invest too much time and money into a full refurbishment. Whilst a bit of maintenance may improve the saleability of your commercial property, it may not necessarily improve its value. So, if you do overspend you may not recoup these costs.

You should also ensure that you are meeting with current hygiene and cleanliness regulations and guidelines, as this may be something your buyers are looking out for.

When someone is interested in buying your commercial property there are a number of documents they are likely to want sight of.

Some will be pertaining to the business within the property itself (if you’re selling it alongside the property). In these cases, one of the first things they will ask to see is the business accounts. We’d recommend having at least three years of financial statements prepared.

The financial documents you will need:

You should ensure that these documents are as honest and as accurate as possible. Here are some other documents you should collate in connection to the business:

Furthermore, there are some documents you will need to compile in relation to the property itself. These include:

Normally, a buyer will ask to see these during their initial enquiry. You can find out more about handling buyer enquiries and viewings in our dedicated guide.

Once you’ve found a potential buyer for your commercial property, the next step is to negotiate the sale price.

A smooth negotiation can only be achieve if you’ve successfully collated the documents outlined above. Not having the correct documentation will put you on the back foot whilst you’re agreeing on a sale price.

This stage can bring about a lot of back and forth. Having a business broker to represent you at this stage can be particularly helpful in achieving the best possible price.

You should negotiate a final price for all aspects of the sale, including the property and, if applicable, the business, assets, stock etc.

Once negotiated, the terms you have agreed will be put into a document called the ‘Heads of Terms’ or ‘Letters of Intent’. This will be drafted for both yourself and your buyer to sign.

You’re sale has now been agreed, but it isn’t legally binding. So, what’s the next stage?

You should speak with your buyer about potential payment options. Will they be paying you the full sale price upfront? Or, would you be in a position to offer owner financing? Owner financing is where your purchaser will pay in stages to spreading the cost of the property.

Owner financing can be popular, but there are risks that come along with it. Make sure you work with a quality solicitor who can advise you along the way.

At Intelligent, we have a panel of trusted partners, including some fantastic commercial solicitors. Sellers who use an Intelligent trusted partner save both time and money, and their sales complete 4 weeks earlier than the industry standard on average.

Your buyer will now begin a process known as due diligence.

You can read our dedicated guide to find out more, but due diligence is essentiall a legal process that your buyer will undertake with their solicitor where they will scrutinise everything about the property and the business (if you’re selling one alongside it).

To keep the process moving as quickly as possible, you should work with your solicitor to answer any enquiries as quickly as possible. You should also start gathering necessary permissions from your bank to transfer any liabilities.

You’ve made it! You’re at the last step of selling your commercial property.

Once your buyer has completed their due diligence, documents are finalised and the money is transferred, you have officially sold your commercial property.

If you’ve included a business in your sale, you might want to think about offering a transitional handover period.

This is where you continue to work for the business for a few weeks to show the new owner the ropes. This can be quite attractive to potential buyers, so you should try to be open to this where possible.

That’s it, our all-encompassing guide about selling your commercial property.

It’s easy to dismiss the process as being simple if you’ve experience in selling residential real-estate, however there are some key differences that make preparation paramount to success.

Selling with Intelligent means you can remove the stress from the sale of your commercial property. We have a dedicated, expert team who work hard to ensure they get to know, your business and your goals.

Ready to start the selling process? Use our valuation tool below to get a FREE and instant valuation of your business.

Get quick and easy insight into the real value of your business, without any obligations.

At Intelligent, all of our experts use a specific formula that will give you a free and highly accurate baseline valuation so that you've got a figure to work with that most realistically resembles the value of your business.